CAC Payback Period in SaaS Companies

Managing finances efficiently is crucial for long-term sustainability and growth. One key metric that plays a vital role in assessing financial health and efficiency is the Customer Acquisition Cost (CAC) Payback Period. In this article, we'll delve into the significance of tracking CAC Payback Period, explore real-world examples, and discuss strategies to improve this critical metric and boost growth for SaaS businesses.

Managing finances efficiently is crucial for long-term sustainability and growth. One key metric that plays a vital role in assessing financial health and efficiency is the Customer Acquisition Cost (CAC) Payback Period. In this article, we'll delve into the significance of tracking CAC Payback Period, explore real-world examples, and discuss strategies to improve this critical metric and boost growth for SaaS businesses.

In this series of articles we are looking closer into common Customer Acquisition Cost (CAC) metrics for businesses, to grasp a better understanding of CAC metrics and how to influence them to reduce CAC. Last article dived into the CAC by Channel metric, which provides insights into the effectiveness of each channel in acquiring customers. Now the time has come to look closer at the CAC Payback Period.

CAC Payback Period

The CAC Payback Period is a crucial metric for SaaS businesses, as it measures the time required to recover the costs associated with acquiring a new customer. By understanding this metric, companies can assess the efficiency of their customer acquisition strategies and make informed decisions about resource allocation. A shorter CAC Payback Period indicates a quicker return on investment, allowing businesses to reinvest in growth initiatives more rapidly. Conversely, a longer payback period may highlight areas where acquisition processes can be optimized to enhance financial performance and sustainability.

CAC Payback Formula

The CAC Payback Period represents the time it takes for a SaaS business to recoup the investment made in acquiring a new customer through the revenue generated from that customer. It is calculated by dividing the CAC by the average revenue per customer per unit of time (e.g., month or year).

CAC Payback = CAC / Average Revenue per Customer

This metric provides insights into the efficiency of customer acquisition efforts and the company's ability to achieve positive cash flow from new customers in a timely manner.

So what is a good CAC Payback Period you may wonder. Well, that depends. For businesses selling to SMEs you would expect a lower CAC Payback Period than for those selling to Enterprises. Essentially, a CAC Payback Period of less than 12 months is great as this signals you have a scalable operation and probably have found your sales process fit. In this case, you should invest more in whatever you are doing (marketing, new sales reps, etc.) as you will get your investment back in less than a year.

Be aware, however, that high performing individuals can influence the metric and that new sales reps usually requires some ramp-up time before hitting their quota. In other words, by investing more in already proven processes may slow them down for a while as your organization get settled.

Normally, for SMEs you would be confident if your CAC Payback Period is lower than 15-18 months, and less than 24-27 months for Enterprises. If your metric is higher than this, you should not freak out but rather look closer into how your sales and marketing process is set-up, and whether it is possible to increase your prices. Generally, if your target audience are SMEs and your CAC Payback Period is 18+ months your sales process is inefficient and you should consider to find more scalable ways to distribute your product.

For an Enterprise-focused company, it might be hard to see how you can improve this metric as the complexity these in sales processes requires more attention from your sales team, however, there are different go-to-market strategies that can be considered such as "land and expand" where you sell a smaller part of your solution with less sales effort and then focus on upsell and expansion strategies.

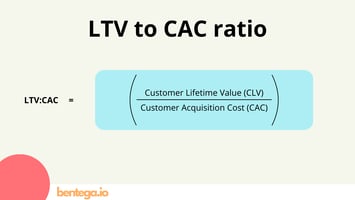

Continuously reducing your CAC Payback Period will help you achieve ARR growth increasing your Monthly Recurring Revenue (MRR) and help you unlock profitability for sustainable growth. Moreover, having healthy CAC levels will improve your CLV:CAC and influence Sales Efficiency Ratio to help you unleash your potential.

Importance of Tracking CAC Payback Period

Tracking CAC Payback Period offers several key benefits for SaaS businesses:

- Cash Flow Management: Understanding the CAC Payback Period helps SaaS businesses manage cash flow effectively by providing visibility into the timing of revenue generation relative to customer acquisition costs. It allows companies to forecast cash flow and plan investments accordingly.

- Financial Health Assessment: The CAC Payback Period serves as a key indicator of financial health and efficiency. A shorter payback period indicates faster return on investment and better cash flow efficiency, while a longer payback period may signal inefficiencies in customer acquisition processes.

- Investment Decision-Making: Insights from the CAC Payback Period help inform investment decisions related to marketing and sales initiatives. It allows companies to prioritize investments that yield quicker payback periods and allocate resources strategically to optimize ROI and Sales Efficiency and performance.

CAC Payback Examples

Let's consider a hypothetical example to illustrate the calculation of CAC Payback Period:

- Company XYZ spends $10,000 on marketing and sales efforts to acquire 100 new customers.

- The average revenue generated per customer per month is $100.

CAC Payback Period = CAC / (Average Revenue per Customer per Month * Number of Months)

In this case:

- CAC Payback Period = $10,000 / ($100 * 1) = 100 months

This analysis reveals that it would take Company XYZ 100 months, or approximately 8.3 years, to recoup the customer acquisition costs through the revenue generated from those customers.

Strategies to Improve CAC Payback Period

- Focus on High-Value Customers:

Identify and prioritize high-value customer segments that have the potential to generate higher revenue and shorter payback periods. Tailor marketing and sales efforts to attract and retain these customers. - Optimize Pricing Strategies:

Review and adjust pricing strategies to increase average revenue per customer and shorten the payback period. Experiment with different pricing tiers, discounts, and packaging options to maximize customer lifetime value. - Enhance Customer Retention:

Invest in strategies to improve customer retention and increase customer lifetime value. Happy and loyal customers are more likely to generate recurring revenue, leading to shorter payback periods and improved cash flow. - Streamline Sales and Marketing Processes:

Identify and eliminate inefficiencies in the sales and marketing processes that may prolong the customer acquisition cycle. Streamline workflows, automate repetitive tasks, and leverage technology to improve efficiency and reduce costs. - Optimize Customer Onboarding:

Ensure a smooth and seamless onboarding experience for new customers to accelerate time-to-value and increase retention rates. Provide proactive support, guidance, and resources to help customers realize the benefits of the product quickly. - Monitor and Adjust Campaign Performance: Continuously monitor the performance of marketing campaigns and channels to identify opportunities for optimization. Allocate resources to channels and initiatives that yield shorter payback periods and adjust strategies as needed.

- Incentivize performance: Design and implement incentive compensation plans to promote efficiency in your organization. Invest in a Compensation Management software such as Bentega.io, to remove the black-box giving your employees a better understanding of how their contributions are valued. Automate commissions to remove administrative work and boost performance.

Conclusion

By tracking and optimizing the CAC Payback Period, SaaS businesses can improve financial health, increase cash flow efficiency, and achieve sustainable growth. Implementing strategies to shorten the payback period not only enhances profitability but also strengthens the company's competitive position in the market. Continuous monitoring, analysis, and optimization are key to maximizing the effectiveness of customer acquisition efforts and driving long-term success in the SaaS industry.

Remember to subscribe to our newsletter to get the latest news and updates from bentega.io.